How to align to achieve efficient revenue growth

-

Align on growing the value of the company

-

Focus on capital-efficient revenue growth with NRR as your NorthStar

-

Schedule efficiency meetings by establishing a GTM operations weekly cadence

Align on growing the value of the company

“Efficiency” is NOT a rallying cry. Yes, everyone in and around SaaS is talking about efficiency but no one is excited about it.

Efficiency isn’t about doing more with less it’s about achieving Capital Efficient Revenue Growth. In other words, SaaS companies need to be profitable while they sustain growth.

Efficient revenue growth improves the value of the company, however, focusing on efficiency is like focusing on dieting to completing a marathon. It’s important but not motivating. Marathon runners don’t run at 4 am because they are excited to diet.

What does efficient revenue growth look like for a SaaS company?

A study of 100 public SaaS companies showed the top 25% most valued companies achieved:

-

YoY LTM Revenue Growth >24%

-

FCF Margin >10%

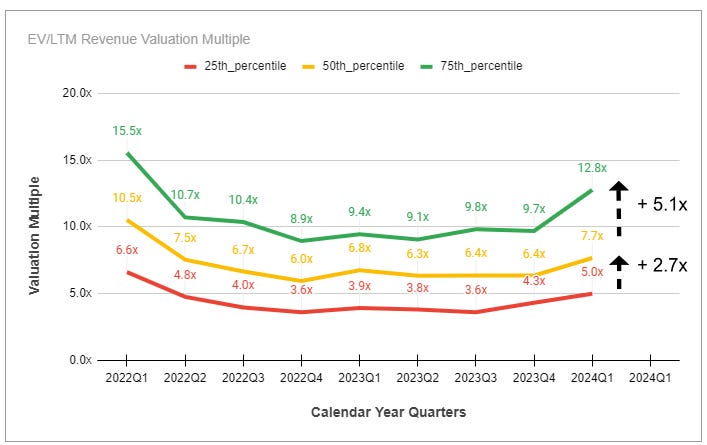

Companies above the 75th percentile enjoyed at least a ~40% increase in their valuation compared to median performers.

-

example of the impact of capital-efficient growth on valuation:

-

a capital-efficient company (24% growth with 10% FCF) with $100M in the last twelve months revenue (LTM) would be $1.2Bn

-

a median performance company (11% Rev Growth with 15% FCF) with $100M in LTM revenue would be worth $770M

-

How does “efficiency” tie to valuation?

Efficiency refers to speed or doing more with less, but in terms of business, it refers to how well a company uses its capital to generate revenue.

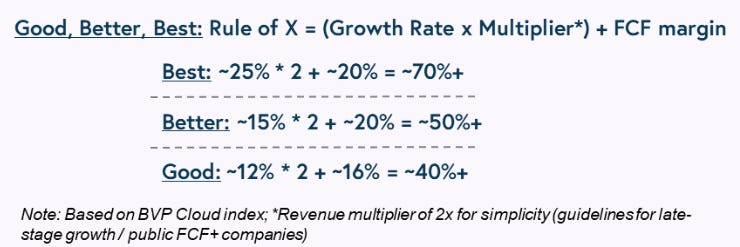

The teams at Meritech Capital and Bessemer Venture Partners (BVP) have studied the correlation of efficiency to valuation and came up with the Rule of X (Meritech calls it “Meritech rule of 40”) which summarily states valuation is:

2 parts Revenue Growth to 1 part Free Cash Flow

Said another way, efficiency is 1/3rd of the equation and growth is 2/3rds.

BVP provides a Good, Better, Best framework below for late-stage public SaaS companies.

For private companies: the Rule of X frames their valuation expectation as:

-

a middle-of-the-pack multiple

-

an above-average multiple

-

a below-average valuation multiple.

For public companies: the Rule of X enables them to focus on being in position for the next bull market as companies that perform above the median enjoy the greatest upswing in their stock price during bull markets.

To put all the talk about efficiency in context…

The era of Growth at all Costs is over.

The “Capital Efficient Growth” era started on Feb 1st, 2023 when Zuckerberg proclaimed “2023 the year of Efficiency”:

Impact:

-

Revenue needs to be managed: Rise of CRO & RevOps in organizations

-

Move beyond reducing churn to achieving & maintaining a NRR >100%

-

New focus on achieving a SaaS Magic # > 1.0 which evaluates Sales & Marketing Efficiency